michigan use tax vs sales tax

Web This is a use tax registration. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items.

Michigan Sales Use Tax Update On Dental Prostheses Part 3 Rehmann

Web Additional advice from Agile Consulting Groups sales tax consultants can be found on our page summarizing Michigan sales and use tax exemptions.

. Web For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under. Web Heres a brief recap on the similarities and differences between sales tax vs. Consistent with Wayfair effective after September 30 2018 Treasury will require remote sellers with.

Web Michigan has a 6 percent sales and use tax rate for retail sales. Web Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. Web For Michigan residents the use tax is reported and paid on the annual Michigan income tax return MI-1040.

Web If you received a Letter of Inquiry Regarding Annual Return for the return period of 2020 visit MTO to file or access the 2020 Sales Use and Withholding Taxes Annual Return. Web The current state sales tax rate in Michigan MI is 6. 18 Merchandise - Sale of merchandise such as calendars plants jewelry blankets and CDs are subject to.

Both sales and use tax. Web To calculate Michigans sales tax multiply the tax rate by the items purchase price. Web Michigan has enacted House Bills 4542 and 4543 which codify the Michigan Department of Treasurys existing economic nexus ruleHouse Bills 4540 and.

2020 Sales Use and Withholding Taxes Annual Return. 2020 Sales Use and Withholding Taxes MonthlyQuarterly Return. This tax will be remitted to the state on monthly quarterly or annual returns as required by the.

Web A seller must register for use tax with the Department of TreasuryOn-line registration is available. For businesses it is done on the same form as. Web The Michigan use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Michigan from a state with a lower sales tax rate.

Vary based on location. Web Most of the states are considered Consumer Tax states. If you are already registered for sales or withholding taxes you only need to.

Web In other words the Court upheld economic presence nexus for sales tax. A sales tax is a fee levied on the sale of certain products and services that is paid to a governing body state. Web The state sales tax rate is 6.

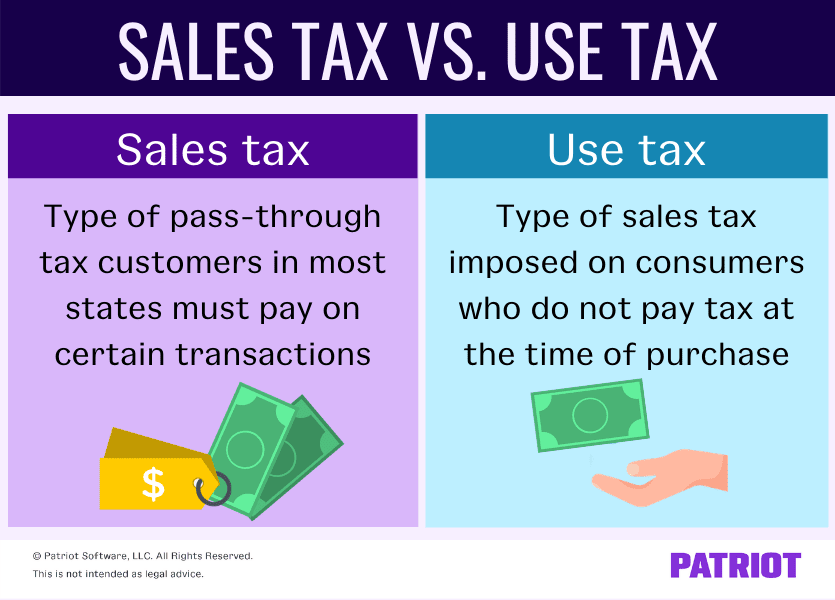

Use Tax is defined as a tax on the storage use or consumption of a taxable item or service on which no sales tax has. Web Prescription medications and prescription eyeglasses are not taxable. Are types of sales tax.

The use tax is not in addition to the sales tax but rather. Certain utilities are taxed at 4 percent. For example if Widget A costs 100 the general tax is 6 percent 100 times 06 equals 6.

CityLocalCounty Sales Tax - Michigan has no city local or county sales tax. Michigans use tax rate is six percent. Michigan first adopted a general state sales tax in 1933.

Rule 41 of the General Sales and Use Tax Law reads in. Web The use tax like the sales tax is assessed upon the end consumer of the tangible property or service but the difference is who calculates the tax and how it is. Web Use tax is a companion tax to sales tax.

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Michigan Representative Makes Push To Exempt Infant Adult Diapers From Sales And Use Tax

Why Is There Sales Tax On Money Numismatic News

Amazon To Charge Sales Tax In 8 More States Jul 18 2012

Michigan Sales Tax Increase For Transportation Amendment Proposal 1 May 2015 Ballotpedia

What Transactions Are Subject To The Michigan Sales Tax Kershaw Vititoe Jedinak Plc

Michigan Sales And Use Tax Certificate Of Exemption

Buying Online To Avoid Sales Tax And Not Paying Use Tax Congress May End That Soon

Sales Tax Vs Use Tax How They Work Who Pays More

Michigan Lawmakers Push Through Sales Tax Break For Trade In Vehicles Avalara

How To File And Pay Sales Tax In Michigan Taxvalet

State Sales And Use Tax Changes In 2019 And What To Expect In 2020 Accounting Today

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Are School Supplies Costing You More Michigan Could Pause Sales Tax On Back To School Products Mlive Com

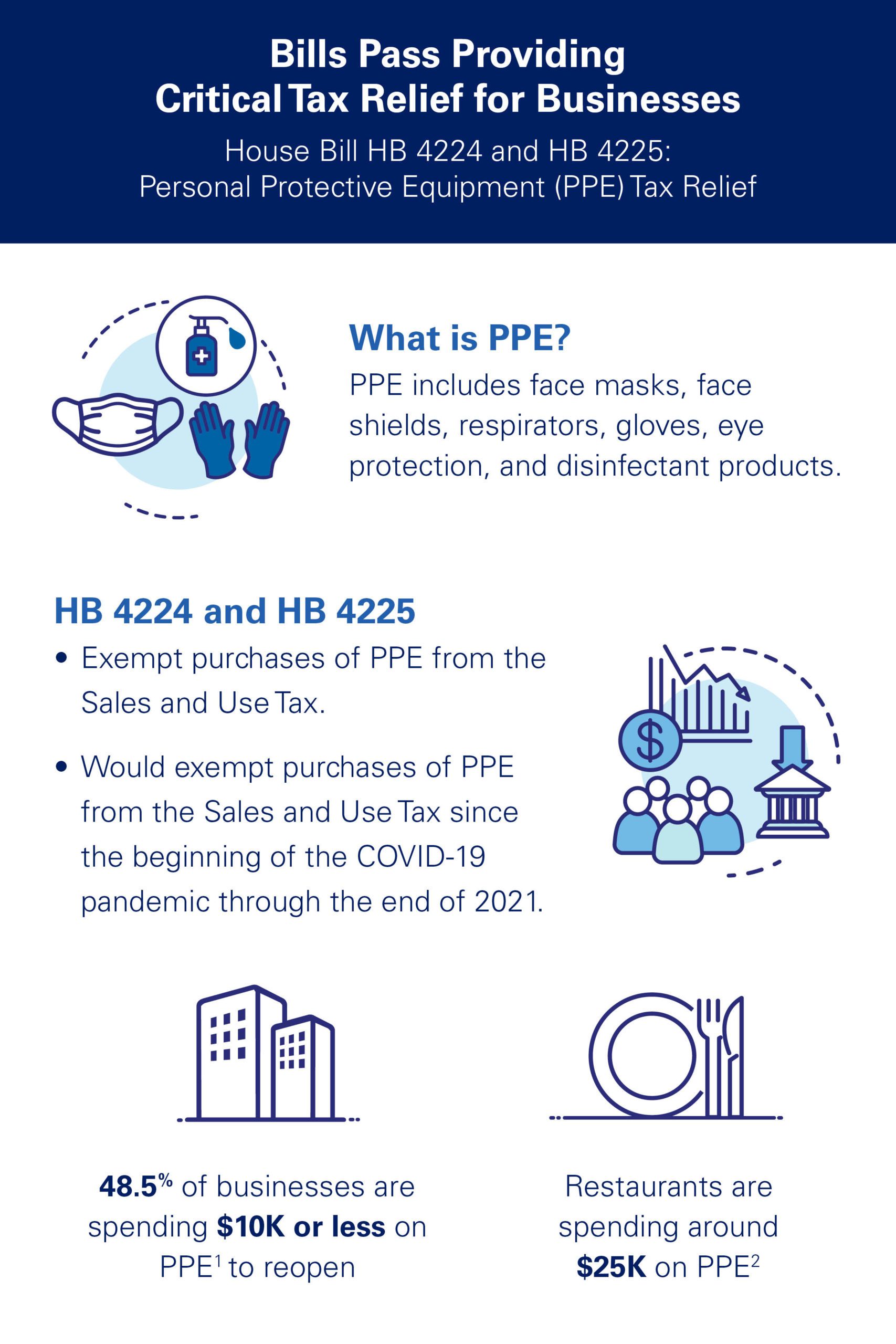

Michigan Safety Equipment Exempt From Sales And Use Tax Doeren Mayhew Cpas

Michigan Sales Use Tax Guide Avalara

State Corporate Income Tax Rates And Brackets Tax Foundation

Polling Shows Why Chamber Backed Ppe Tax Relief Critical For Michigan Recovery Detroit Regional Chamber

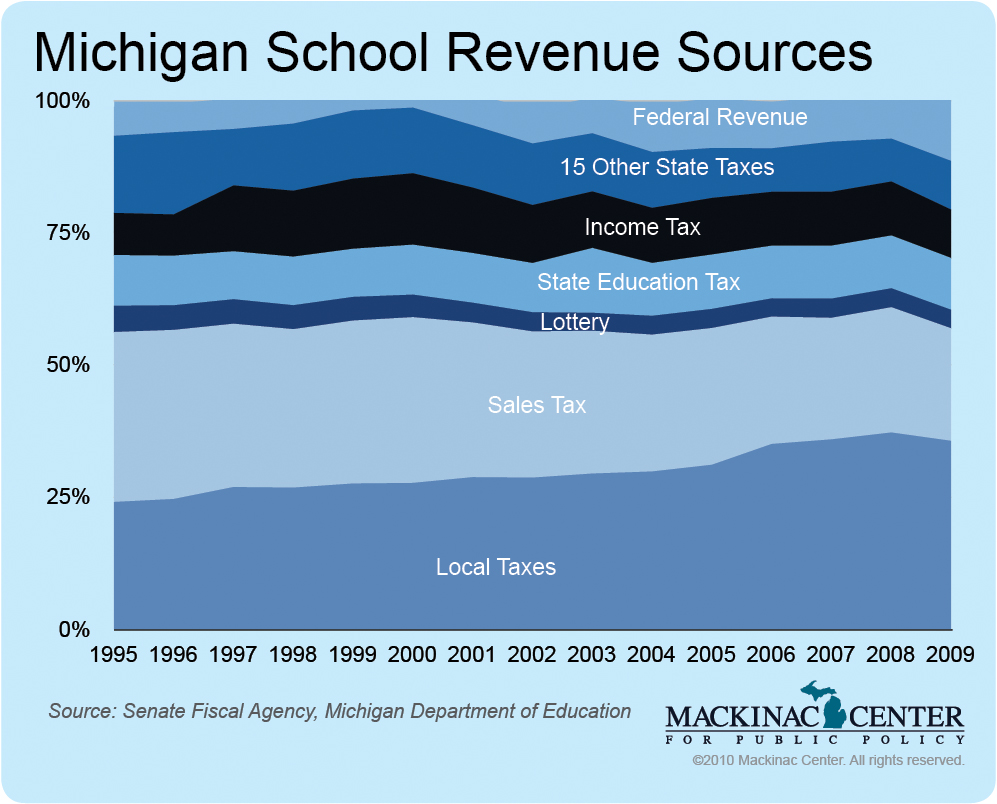

6 The Sales Tax And Lottery Myth School Funding In Michigan Common Myths Mackinac Center